Uncategorized

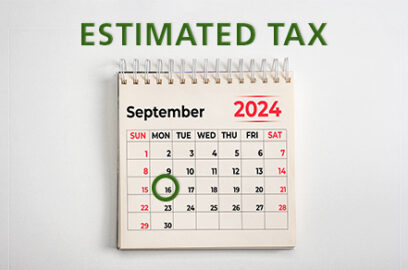

Do you owe estimated taxes? If so, when is the next one due?

Hot Topic Webinar: Making the Most of Your 401(k): Small Business Retirement Plan Design

How SaaS Companies Can Use KPIs to Evaluate Success

The Critical Distinctions: CFO vs. Controller

Top Accounting Firm Rankings: BGM’s Performance Highlighted

The Value of Using Trusts to Pass Inheritance Versus Outright Gifts to Children

Midyear Tax Check-In: Do You Have an Optimized Tax Strategy?

Key Steps to Take When You Inherit a Large Sum: A Financial Guide

The tax implications of disability income benefits