Inherited IRAs: RMD Planning and 7 Things to Know

Key Takeaways:

- Withdrawal strategies for IRA inheritors who do not meet the definition of an eligible designated beneficiary are no longer predefined. Therefore, a material planning opportunity exists to sequence withdrawals in a tax-efficient manner that could lead to a larger inheritance when the account is ultimately unwound.

- Be careful with trusts as beneficiaries. There are trade-offs between the accumulation of RMDs held in trust for the future benefit of beneficiaries and tax efficiency.

- Understand the tax consequences of distributions from inherited accounts. An IRA distribution may not be the most tax-efficient way to access funds from your inheritance.

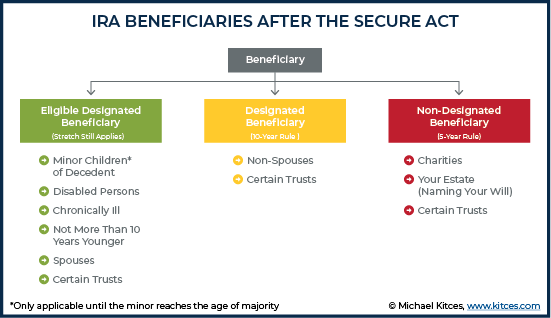

One of the most significant changes coming out of the SECURE Act, passed in the final days of 2019, was the redefining of IRA beneficiaries and their associated distribution requirements.

The ‘’stretch” Required Minimum Distribution (RMD) rules still apply to spouses, minors (only until they reach the age of majority), disabled or chronically ill heirs, and individuals not more than 10 years younger than the decedent. That is, the beneficiary can spread out the distributions over their life expectancy.

However, for most other beneficiaries, the new standard under the SECURE Act is the 10-year rule (non-designated beneficiaries may have to wind down inherited IRAs within a five-year window). The diagram below illustrates the new beneficiary definitions.

These modifications are a material change for non-eligible designated beneficiaries that significantly accelerates the income recognition of required minimum distributions (RMDs) from inherited IRAs.

To further complicate the issue, annual distributions are no longer required within the 10-year window. (Planning note: This flexibility introduces a potential tax planning opportunity for inheritors depending on their income profile and stage of life.)

Seven Other Inheritance Rules to Know

Outside of the elimination of the stretch provision for inherited IRAs, here are seven other critical pieces of information to know before determining an appropriate withdrawal strategy given your circumstances.

1. No Roth conversions: Account owners of traditional IRAs, and spousal beneficiaries of inherited IRAs, can execute Roth conversions in any tax year. However, non-spousal beneficiaries of inherited IRAs cannot execute Roth conversions.

2. Designate a beneficiary, but be careful with trusts: Consider the trade-offs between asset protection/control and tax efficiency before naming a trust as the beneficiary of an inherited IRA. In most cases, distributions from IRAs retained in a trust will result in income being taxed at compressed tax brackets, resulting in a larger tax bill and a smaller ultimate inheritance.

However, the distribution of RMDs to beneficiaries may not align with your overall estate plan. It’s common to create inheritance trusts to separate inherited assets from personal/marital assets, but careful consideration is required to ensure the trust is drafted so that the outcome is aligned with your legacy wishes.

This process can get complicated quickly, so it’s best to err on the side of caution and consult with a qualified estate attorney and tax advisor.

3. No step up in basis: Some inherited assets may qualify for a step up in basis at the decedent’s date of death. This is a powerful tax provision as any tax liability for unrealized gains effectively evaporates when the cost basis is adjusted to the fair market value at the date of death. Unfortunately, this tax provision provides no benefit to inherited IRAs as they do not qualify for a basis adjustment.

4. Distributions are taxable: Inheritances are generally viewed as tax-free transfers of wealth. However, the type of asset and account in which the funds are located will dictate the taxability of the inheritance. Non-Roth distributions from inherited IRAs are taxable to the beneficiary in the year of distribution and taxed at the ordinary income tax rates of the inheritor.

5. Multiple beneficiaries: When multiple beneficiaries inherit an IRA, they have until 12/31 of the year following the owner’s death to split the original account into separate inherited IRAs for each beneficiary. Before transferring beneficial shares, the required minimum distribution for the year of death must be distributed from the original account.

Finally, there are a few things you cannot do with an inherited IRA that you normally could with your own individual retirement account:

6. Can’t consolidate balances or aggregate RMDs: Owners of multiple individual retirement accounts can consolidate assets into one account. Similarly, inheritors of multiple IRAs from the same person can consolidate those accounts to ease administration and investment management.

However, unless you are a spousal beneficiary, you cannot consolidate your own IRAs with inherited IRAs. The same logic applies to the aggregation of required minimum distributions.

7. Can’t contribute to inherited IRAs: Contributing to an inherited IRA is prohibited.

Receiving an inheritance can be overwhelming, and the administration of an estate can be a disjointed and time-consuming process. Before making any decisions, reach out to a financial advisor with experience navigating the estate administration process. The right advisor can help reduce your financial anxiety, simplify your life, and give you confidence that you are making informed, emotionally unattached decisions regarding your financial windfall.

If you have questions or would like to learn more, please fill out our contact form to schedule an appointment with our team.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.