July Market Review

Small Cap Equities Heat Up in July

Falling Rates and Softer Inflation Contribute to a Reversal in Market Leadership

July 2024

Key Observations

- Softer inflation data released in July pushed interest rates lower, and market expectations for a September Federal Reserve rate cut are almost fully priced in. More rate-sensitive assets fared well.

- Market leadership shifted on the back of lower rate expectations and the positive impact that may have on small cap equities, which had their third-best month relative to large cap since 1979.

- The darling AI stocks and other Mag 7 positions took a step back in July. Investor questions surrounding future earnings, capex, and the future monetization of AI all took hold and contributed to the sell-off in the back half of the month.

Market Recap

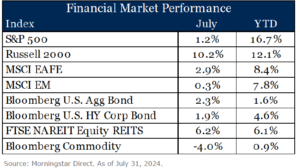

The second half of the year kicked off with no shortage of events. A favorable inflation print, weakening labor market data, and political events surrounding the fall election all contributed to the spike in volatility during the month. Expectations of an interest rate cut from the Federal Reserve continue to underpin investor sentiment, and we saw a significant shift in market leadership (which we explore below) following the CPI release mid-month. The concentrated large cap leadership from the first half of the year changed course, with the S&P 500 Index producing a modest positive return, while U.S. small cap equities (Russell 2000 Index) had a standout month. International equities also moved higher, with developed markets (MSCI EAFE Index) producing a modest positive return, while emerging markets (MSCI EM Index) were roughly flat for the month. Increased rhetoric and uncertainty about foreign tariffs negatively impacted China, one of the weaker-performing regions within emerging markets.

The second half of the year kicked off with no shortage of events. A favorable inflation print, weakening labor market data, and political events surrounding the fall election all contributed to the spike in volatility during the month. Expectations of an interest rate cut from the Federal Reserve continue to underpin investor sentiment, and we saw a significant shift in market leadership (which we explore below) following the CPI release mid-month. The concentrated large cap leadership from the first half of the year changed course, with the S&P 500 Index producing a modest positive return, while U.S. small cap equities (Russell 2000 Index) had a standout month. International equities also moved higher, with developed markets (MSCI EAFE Index) producing a modest positive return, while emerging markets (MSCI EM Index) were roughly flat for the month. Increased rhetoric and uncertainty about foreign tariffs negatively impacted China, one of the weaker-performing regions within emerging markets.

Fixed income markets fared well in the wake oflower interest rates, and the Bloomberg U.S.Aggregate Bond Index moved into positiveterritory for 2024. U.S. CPI fell 0.1% seasonally adjusted in June, the first month-over-month decline since July 2022. The Federal Reserve held the fed funds rate steady at 5.25%-5.5% during the July meeting but acknowledged the recent inflation data and a softer labor market in its statement. Other diversifying asset classes had mixed results during the month. Real estate has been nothing short of volatile this year, and with the outlook for Fed cuts on the horizon, REITs also moved back into positive territory during July. On the other hand, commodities took a step back and were one of the few areas of the market in negative territory for the month. Supply-demand dynamics negatively impacted oil prices, and industrial metals also had a weak month.

Fixed income markets fared well in the wake oflower interest rates, and the Bloomberg U.S.Aggregate Bond Index moved into positiveterritory for 2024. U.S. CPI fell 0.1% seasonally adjusted in June, the first month-over-month decline since July 2022. The Federal Reserve held the fed funds rate steady at 5.25%-5.5% during the July meeting but acknowledged the recent inflation data and a softer labor market in its statement. Other diversifying asset classes had mixed results during the month. Real estate has been nothing short of volatile this year, and with the outlook for Fed cuts on the horizon, REITs also moved back into positive territory during July. On the other hand, commodities took a step back and were one of the few areas of the market in negative territory for the month. Supply-demand dynamics negatively impacted oil prices, and industrial metals also had a weak month.

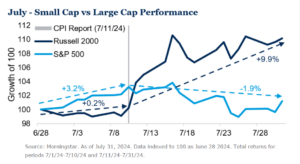

Market Leadership Shifts in July

The U.S. inflation report on July 11 marked a turning point for the markets. While levels in headline inflation remain above the Fed’s 2% target, the trend lower over recent months has solidified investor expectations of a rate cut in September. Further supporting investor sentiment was softer labor market data. However, we’d be remiss to point out that, despite the recent unemployment rate uptick, the overall labor market has remained resilient thus far. Small cap equities surged in the back half of the month following the inflation print and ended the period 10.2% higher. Additionally, investors began to have questions regarding the monetization of AI and the enormous amount of capital expenditures many companies were making in the space, putting pressure on the “Magnificent 7,” which fell 0.6% on average in July. While enthusiasm has softened somewhat on the AI craze from earlier in the year, investors will be keying in on the earnings releases in early August for several of these companies. This environment culminated with small cap having its third-best month relative to large cap since 1979. Value stocks also shined relative to their growth equity counterparts, benefiting from many of the factors that helped small cap.

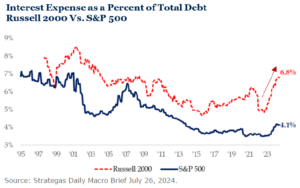

Lower interest rates and expectations for the Federal Reserve to start easing in September were the driving force behind the small cap rally, but let’s take a deeper look at one of the reasons why. Historically, interest expense for small cap companies has been greater compared to larger cap companies.

Intuitively, this makes sense given they are “riskier,” and therefore, the cost of financing is more expensive. When the Federal Reserve began its tightening cycle in 2022, small caps were disproportionately impacted relative to large caps. Therefore, one could reasonably conclude that small caps may have a greater tailwind if interest rates start to decline.

makes sense given they are “riskier,” and therefore, the cost of financing is more expensive. When the Federal Reserve began its tightening cycle in 2022, small caps were disproportionately impacted relative to large caps. Therefore, one could reasonably conclude that small caps may have a greater tailwind if interest rates start to decline.

Outlook

As we look forward, it’s hard to call one month (or half a month for that matter) a trend, but we believe the multiple paths lower for the Fed may provide a tailwind for fixed income and the concentration within large cap creates both risks and opportunities. While we do not try to time the market, we recognize the potential opportunities outside of the handful of stocks that have driven much of the market gains over recent months and remain committed to diversified portfolio allocations as we prepare for markets ahead.

1. FactSet, BLS. As of July 11, 2024.

2. CME FedWatch. As of July 31, 2024, there was an 88.1% probability of a 25 bps cut and an 11.8% probability of a 50 bps cut at the Federal Reserve September meeting.

This report is intended for the exclusive use of clients or prospective clients (the “recipient”) of BGM Wealth Partners and the information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of BGM Wealth Partners is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on BGM Wealth Partners research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impact by currency and/or country specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.