November 2026 Market Review

A Pause for Perspective

What the recent commotion in markets reveals about the underlying cycle.

November 2026

Key Observations

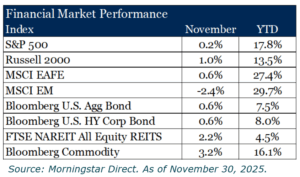

- After a brisk rally in October, November saw muted returns across most asset classes.

- Policy participants have expressed sharply divergent views on future interest rate decisions, leaving investors cautiously optimistic.

- Leadership rotated toward real assets and commodities, while emerging markets lagged.

- Persistent concentration and high valuations raise the possibility of fragility in markets and warrant thoughtful portfolio construction as we look to 2026

Market Recap

November’s market action was defined by turbulence. The S&P 500 fell over 3.0% during the first three weeks of the month on fears of an AI bubble. However, near the end of the month, fears receded on expectations for interest rate cuts. Therefore, the S&P 500 posted a modest gain of 0.2%. Small caps, represented by the Russell 2000, outperformed with a 1.0% advance, hinting at a tentative rotation away from mega-cap dominance.

International developed equities, as measured by the MSCI EAFE Index, rose 0.6%, supported by a softer dollar and improving sentiment in Europe and Japan. In contrast, emerging markets declined 2.4%, as China’s recovery stalled and geopolitical risks weighed on sentiment.

Fixed income saw modest gains, as both the Bloomberg U.S. Aggregate and High Yield Indexes advanced 0.6% amid falling rates and resilient credit fundamentals. Attention now turns to the Fed’s December meeting, where views on policy direction vary widely. Many expect another cut could be warranted, though several caution against moving too quickly. Others argue that maintaining the current range may be the prudent course if economic trends hold. The outcome will likely hinge on whether incoming data confirms expectations for continued economic stability.

Real assets led the month, with REITs up 2.2% and commodities rallying 3.2% on renewed demand and supply constraints. Lodging/resorts and healthcare were the best-performing REIT sectors driven by a resilient consumer and improving fundamentals. Precious metals boosted commodities on the back of inflation concerns and a depreciating U.S. dollar.

A Pause for Perspective

Markets navigated a turbulent November as headlines shifted from government shutdown risks to delayed economic releases and renewed debate over AI valuations. While price action captured attention, it tells only part of the story. The market’s recent behavior invites a deeper look at what is driving returns beneath the surface.

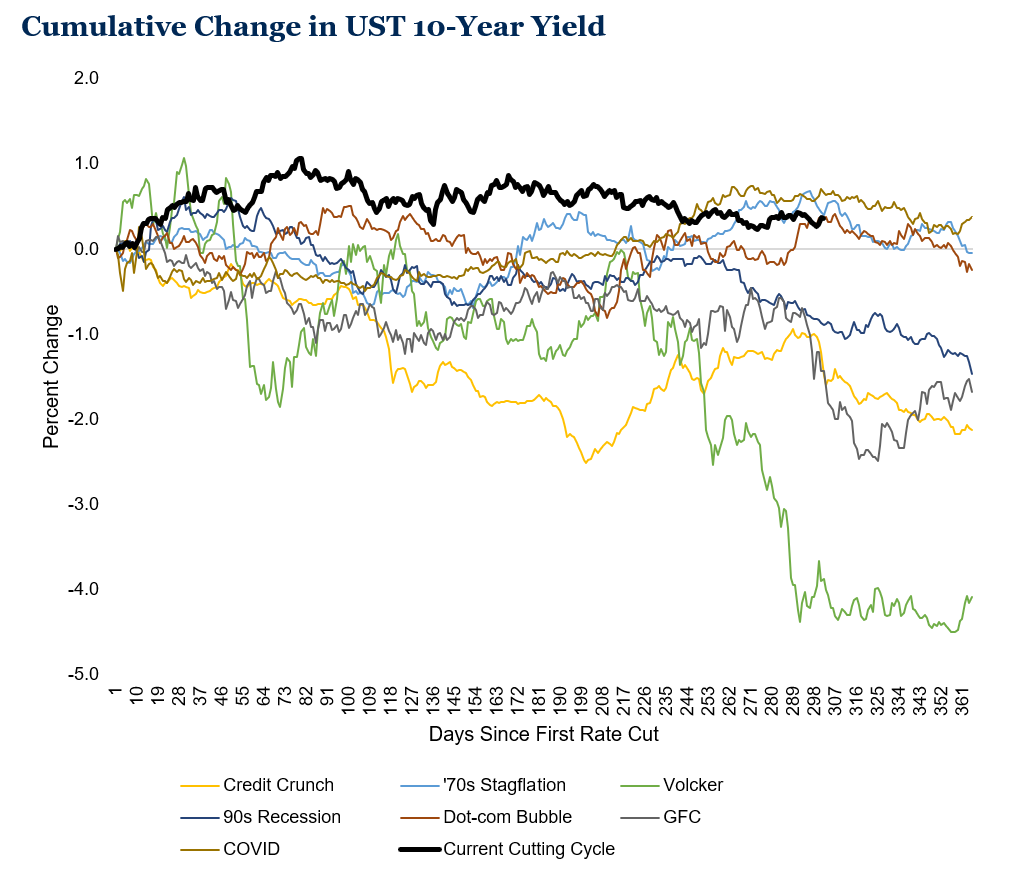

We have now had 150 basis points of rate cuts since the first cut in 2024. The bond market has exhibited a unique response to Fed action, with the long end of the curve persistently rising. In fact, the only significant historical period with similar market action was during 1970s stagflation. Today, the bond market is seemingly pricing in similar concerns about inflation. This raises the question: What happens when the Fed stops cutting rates? For investors, active management in fixed income may help navigate what could be a nonlinear rate environment.

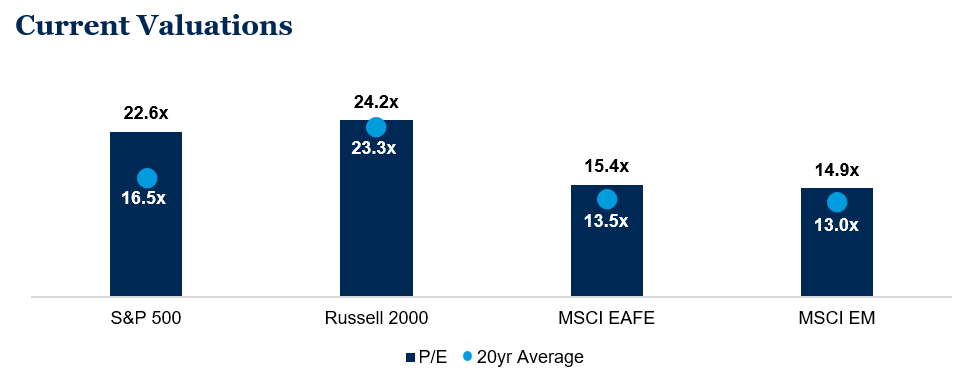

Valuations remain elevated across major indices. The S&P 500’s year-to-date gain of 17.8% leaves earnings multiples above historical averages. Positive earnings growth provides some justification, but the margin for error narrows. For long-term investors, being mindful of current valuations and thoughtfully allocating portfolios may help attain investment goals.

Source: FactSet, as of November 30, 2025.

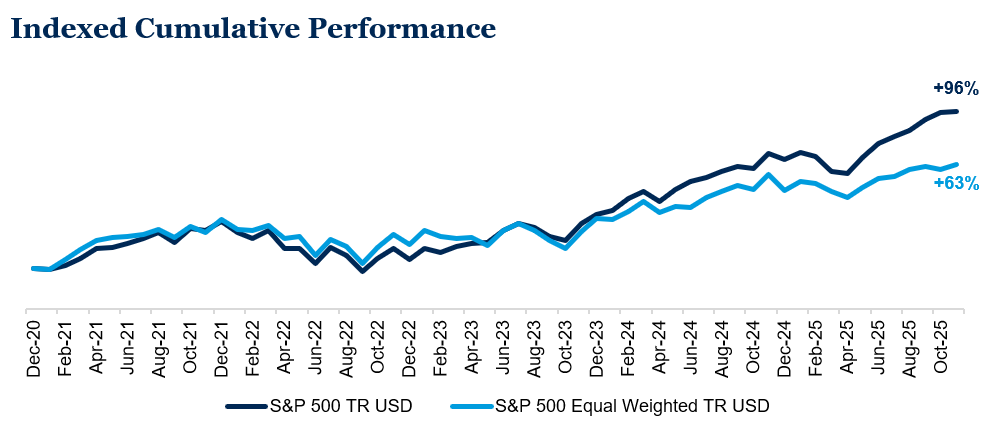

Market concentration remains a defining feature and creates structural risk in portfolios that are not diversified. Today, the top 10 stocks in the S&P 500 make up 40% of the total market capitalization, driven predominantly by enthusiasm in AI-related constituents.1 Astonishingly, NVIDIA’s market cap has grown to nearly twice the size of the entire Russell 2000.1 Market leadership has created significant performance dispersion amongst index constituents. This has become more profound since the beginning of 2024. Concentration amplifies both risk and opportunity. Understanding how portfolios are positioned and the underlying exposures will help investors weigh potential market scenarios and the impact they may have on investment outcomes.

Source: Morningstar, as of November 30, 2025.

Outlook

As the year winds down, markets remain supported by moderating inflation, stable monetary policy, and a favorable corporate fundamental backdrop. However, elevated valuations, concentration driven by the strength in AI-related securities, and persistent macro uncertainty call for thoughtful diversification and disciplined risk management. Our upcoming 2026 outlook will explore some of these themes in greater depth and provide guidance for positioning portfolios in an evolving market environment as we head into the new year.

Sources

1. Source: Morningstar Direct, as of November 30, 2025.

Disclosures & Definitions

This report is intended for the exclusive use of clients or prospective clients (the “recipient”) of BGM Wealth Partners and the information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of BGM Wealth Partners is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on BGM Wealth Partners research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and sourced from Morningstar or FactSet unless otherwise listed.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually, weighted 2/3 by trading volume and 1/3 by world production, and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default, and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices takes place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices takes place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country-specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but not limited to economic conditions, change in condition of the underlying property, or defaults by the borrower.

- All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance.