News + Insights

Access Our Wealth of Knowledge

Browse BGM’s collective financial knowledge across a wide variety of topics and industry specific insights, as well as the most up to date news on our firm.

Focus

Benefits of Family Office Services

Brand audits can help companies in a variety of ways

Beneficial Ownership Information (BOI) Filing Webinar

Understanding the Federal Estate Tax Exemption: What You Need to Know

July Market Review

Cash or accrual accounting: What’s best for tax purposes?

Does your company have an EAP? If so, be mindful of compliance

Optimizing Gifting Strategies to Minimize Taxes

Understanding taxes on real estate gains

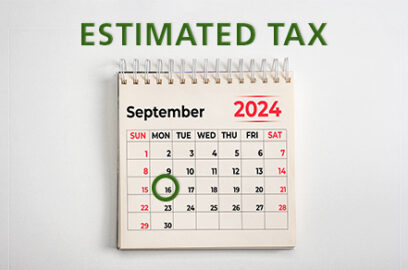

Do you owe estimated taxes? If so, when is the next one due?

Hot Topic Webinar: Making the Most of Your 401(k): Small Business Retirement Plan Design

How SaaS Companies Can Use KPIs to Evaluate Success

The Critical Distinctions: CFO vs. Controller

Top Accounting Firm Rankings: BGM’s Performance Highlighted