Tax Insights: What You Need to Know for This Year’s Filing

Tax time is upon us once again, and at BGM, we are fully equipped to assist you in preparing your 2023 tax returns. The process has already commenced, with all individual organizers and business portal links sent out. The IRS has also opened the 2023 e-file season. Below you will find helpful information as we start the year, including tax bracket adjustments, tax legislation, and helpful tips for a smooth tax season.

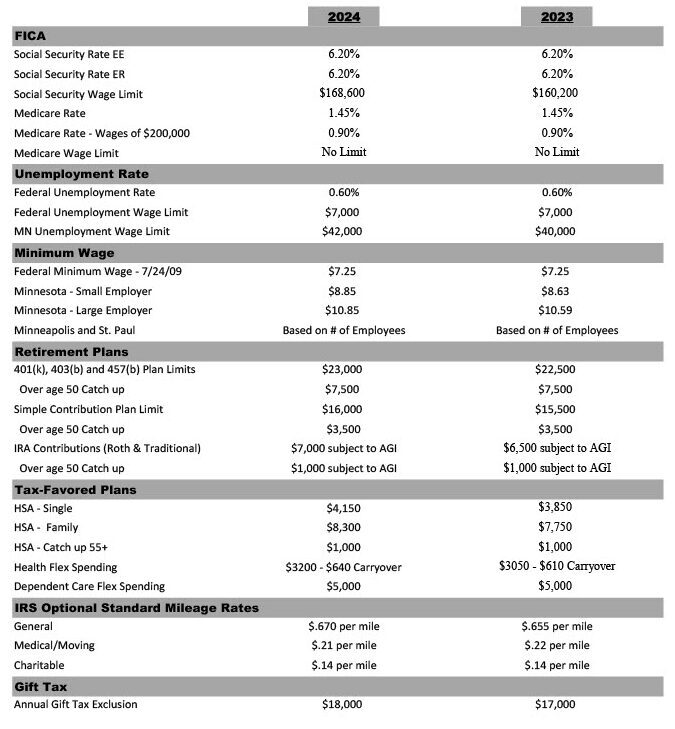

Looking at 2024

Stay informed with our comprehensive 2024 Key Fact Sheet, which encompasses crucial information such as:

- Social Security, Medicare, and Unemployment Rates

- Federal Minimum Wage

- Retirement and IRA Contribution Limits

- Health Savings Accounts Contribution Limits

- Mileage Rates

- Gift Tax Annual Exclusion

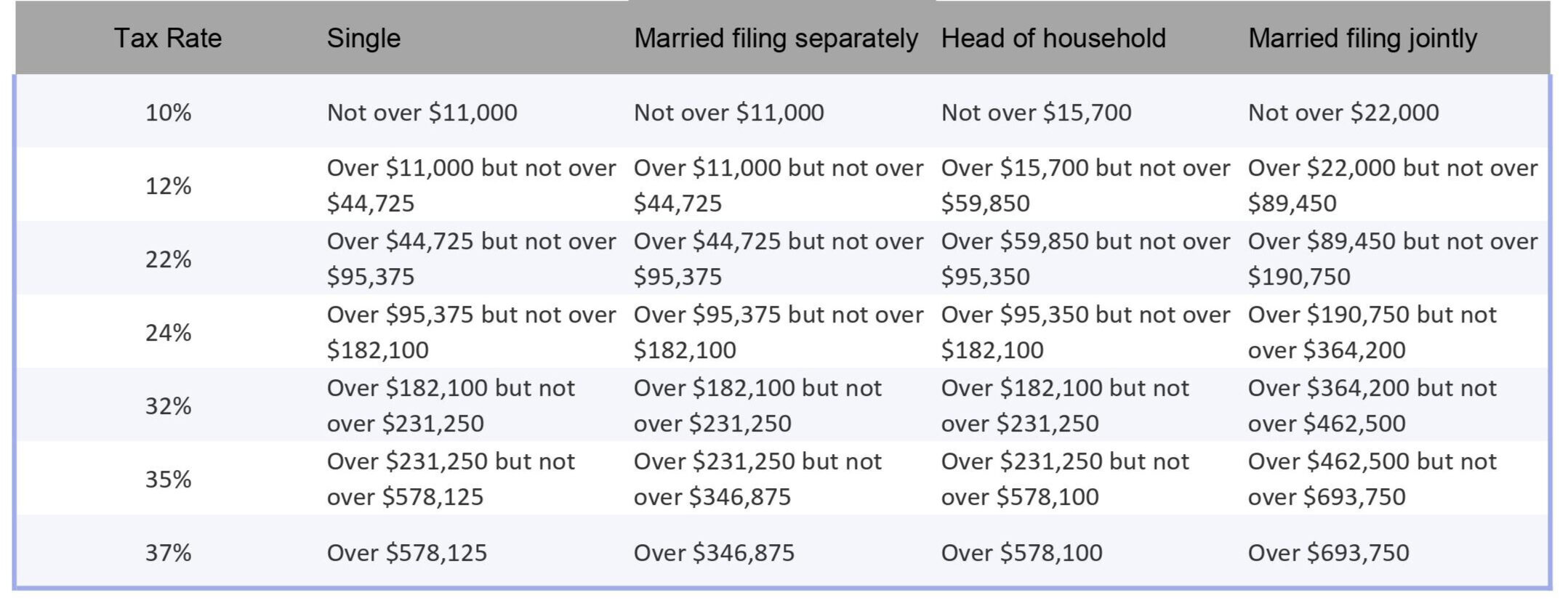

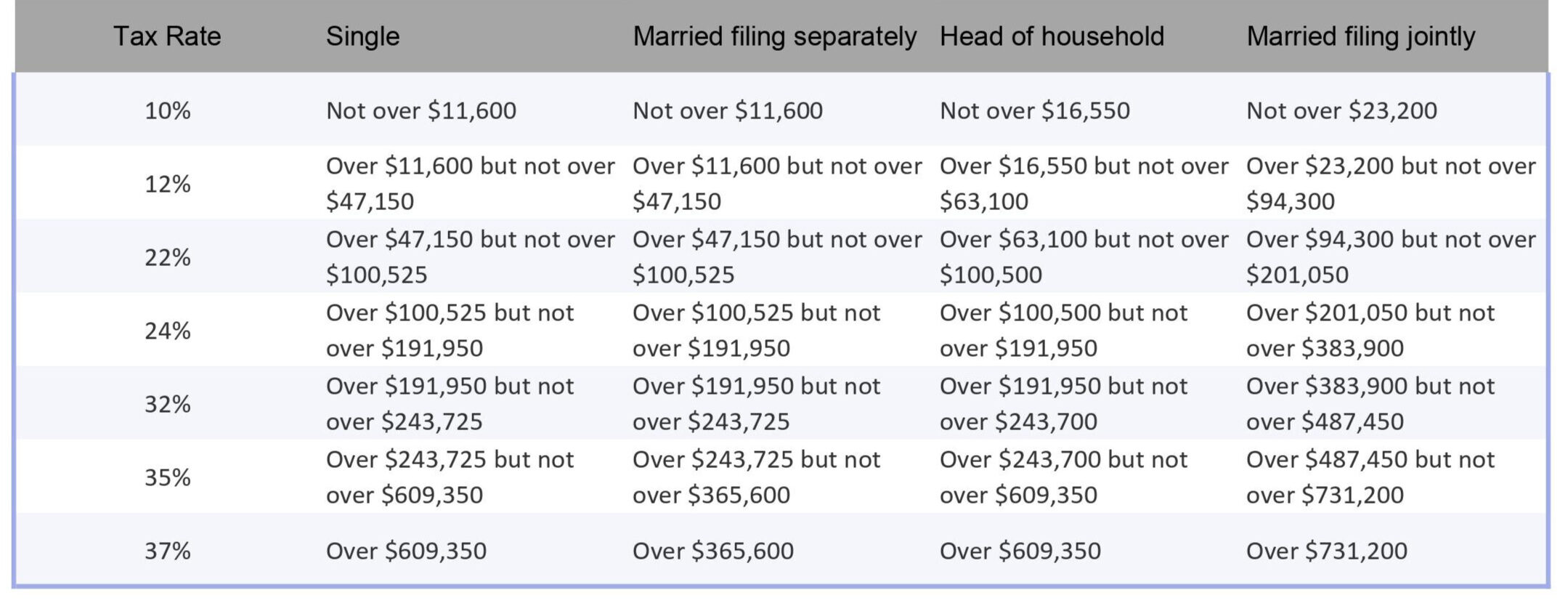

Understanding Tax Brackets

The IRS has announced its 2024 inflation adjustments. While the U.S. income tax brackets remain unchanged, the income subject to progressively higher rates will be adjusted. Here’s an overview of the tax brackets for both the 2023 and 2024 tax years, aiding in your estimation of expected payments.

Insights into Tax Legislation

Currently, pending tax legislation may still pass, which could affect the preparation of your 2023 tax return. The following are the significant provisions that could impact your tax filing:

- The bill would expand the child tax credit’s refundable amount currently at $1,600 per child, to a maximum of $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025. The expansion would expire after that. Additionally, the bill would temporarily adjust the topline credit amount to grow at the rate of inflation.

The bill changes the deductibility of Research and Development expenses. Beginning in 2022, these expenses were no longer deductible in the current year. Rather, they would be written off over five years.

- The bill aims to revert this change.

- It also seeks to amend bonus depreciation. For 2023, bonus depreciation was reduced from 100% to 80%, with the remaining 20% depreciating over five or seven years. The bill would maintain the 100% bonus depreciation for 2023.

- The Employee Retention Credit filing deadline has moved to January 31, 2024, for 2020 and 2021 amended returns.

Preparation Tips for a Smooth Filing Process

To help prepare your business tax returns most securely and efficiently, we suggest doing the following:

- Sign the engagement letter sent to your e-mail via Safesend Signatures.

- Use the Suralink business portal to upload your business records. The portal outlines the requested information.

- Suralink allows back-and-forth correspondence to answer questions and resolve issues to complete the return.

To help prepare your individual return, please complete the online organizer you received via Safesend Organizer as thoroughly as possible.

- Sign the engagement letter and answer all the yes/no questions. These questions ensure we include all relevant information on your return.

- Complete the remaining pages of the organizer and upload the source documents you have received. The organizer would indicate if you had an item in the previous year.

- Accuracy is critical to preventing future issues or corrections arising from incomplete information.

Proactive Tips for 2024

For those finding the 2023 submission process time-consuming or stressful, we advise initiating preparations for 2024 now. Tracking income and expenses throughout the year, whether through accounting software like Quickbooks or spreadsheet summaries, can greatly alleviate year-end processes. Maintaining up-to-date information fosters strategic tax planning and facilitates sound financial decision-making.

Organizing tax information, whether electronic or physical, in one accessible location proves advantageous for both business and individual tax purposes. In anticipation of potential events that may impact your tax situation in the coming year, do not hesitate to reach out to your BGM tax professional for guidance or utilize our Contact Us form.

Get guidance from the tax professionals at BGM.

Proactively preparing tax planning strategies can lead to significant tax savings and a smoother filing experience next year.