Tax Planning Tips for Exercising Stock Options

Stock options have become a powerful tool in modern compensation packages, offering employees the potential for significant financial growth. However, the path to maximizing their value is fraught with complex tax implications that can catch even the most financially savvy individuals off guard.

Drawing from my early experience as a golf course caddie, I learned that success comes from understanding the full landscape and making strategic decisions. Similarly, navigating stock options requires a comprehensive approach that goes beyond simply exercising your right to purchase company shares.

Understanding Different Types of Stock Options

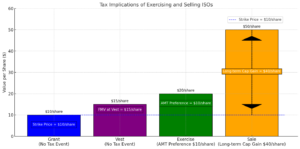

Incentive Stock Options (ISOs)

Incentive stock options represent a potentially lucrative form of compensation with unique tax advantages. Unlike standard compensation, ISOs offer the possibility of paying capital gains tax rates instead of ordinary income tax. However, this benefit comes with strict requirements that can be challenging to navigate.

Example Scenario:

Imagine you work at a new startup and receive 1,000 ISOs with an exercise price of $10 per share. One year later at the vesting date, the options are worth $15 per share. Here’s how the tax implications unfold:

- No immediate tax at the grant or vesting date.

- If the company’s valuation increases to $20 per share at exercise, you won’t immediately owe ordinary income tax.

- You’ll need to be aware of alternative minimum tax (AMT) implications, which is also known as the bargain element (the difference between exercise price and grant price).

- If you sell when the stock reaches $50 per share and meet the holding requirements (at least one year after exercise and two years after grant), you’ll be taxed at the long-term capital gain rate on $40 per share.

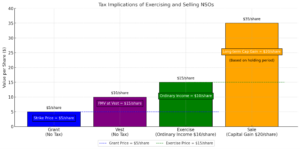

Non-Qualified Stock Options

Non-qualified stock options are more straightforward but come with different tax consequences. When you exercise NSOs, the difference between the exercise price and the market value is immediately taxed as ordinary income.

Example Scenario:

You receive NSOs from work with a grant price of $5. One year later at the vesting date, the options are worth $10 per share. Here’s how the tax implications unfold:

- No immediate tax at the grant or vesting date.

- If the company’s valuation increases to $15 per share, you will pay ordinary income tax of $10 per share (the difference between the exercise price and grant price).

- If you hold the stock after you exercise for more than one year and you sell when the value is at $35 per share, you’ll realize $20 in long-term capital gains per share (difference between price of sale and exercise price).

Key Takeaway: After exercising stock options, you’ll follow the capital gains schedule:

- Selling one year after the exercise date: Long-term capital gains rates.

- Selling before one year from the exercise date: Short-term capital gains rates (ordinary income).

Immediate Tax Implication

Navigating the Alternative Minimum Tax (AMT)

The alternative minimum tax is perhaps the most complex tax consideration for ISO holders. This parallel tax system can create unexpected tax liabilities that catch many employees by surprise.

Example Scenario:

Lisa receives 2,000 ISOs with an exercise price of $20. When the stock reaches $40, she exercises the options:

- For AMT purposes, the $20 spread per share could trigger a significant tax bill.

- She may owe taxes even though she hasn’t sold the shares or realized cash gains.

- If her total AMT calculation exceeds her regular tax liability, she’ll need to pay the higher amount.

Strategic Approaches to Exercising Options

Timing and Strategy: Lessons from the Golf Course

Exercising stock options is more than a financial transaction—it’s a strategic decision that requires careful consideration of multiple factors. Just as a golfer reads the terrain before hitting a shot, you must analyze your company’s trajectory and personal financial goals.

Strategic Exercise Considerations:

Consider Spencer, who works at a rapidly growing startup. His potential strategies include:

- Early Exercise: Capitalize on low share prices to minimize future tax liability.

-

- Potential benefit: Lower AMT impact.

- Risk: The company may not succeed.

- Delayed Exercise: Wait for more significant company growth.

-

- Potential benefit: Clearer company valuation.

- Risk: Higher exercise costs and potential tax complications.

Diversification: Avoiding Financial Hazards

Many employees make a critical mistake by concentrating too much wealth in company stock. This approach is like a golfer using only one club—risky and limiting.

Diversification Example:

Grace receives stock options at a tech company.

- Initial position: 10,000 shares worth $150,000.

- Grace’s strategic approach:

- Gradually sell shares.

- Reinvest in diverse asset classes.

- Create a balanced investment portfolio.

Common Pitfalls to Avoid

- Missed Deadlines: Options have expiration dates. Missing these can result in forfeiting potentially valuable assets.

- Tax Miscalculations: Underestimating tax liabilities can lead to unexpected financial strain.

- Lack of Professional Guidance: The complexity of stock options demands expert consultation.

Conclusion

Stock options are powerful financial instruments that require a strategic, holistic approach. By understanding the nuanced tax landscape, developing a thoughtful plan, and remaining adaptable, you could transform these compensation tools into significant wealth-building opportunities.

Remember: Just as a skilled golfer reads the entire course before making a shot, successful stock option navigation requires comprehensive understanding, strategic planning, and continuous learning.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.