Understanding the Federal Estate Tax Exemption: What You Need to Know

Estate tax comes into play on the transfer of wealth from a deceased person to their heirs. Estate planning is crucial to help pass as much wealth as possible in a tax-efficient manner to your beneficiaries.

The federal estate tax exemption serves as a critical tool, offering the opportunity to protect assets and secure the financial future of loved ones. With current exemption levels at a historic high, you can utilize various estate planning tools to help maximize the transfer of wealth to your heirs while minimizing tax liabilities.

By taking advantage of trusts, gifting strategies, and other estate planning tactics within the framework of the exclusion, you can help ensure that your assets are distributed according to your wishes in a tax-efficient manner.

What Is the Federal Estate Tax Exemption?

The federal estate exemption allows you to transfer a certain amount of wealth without incurring gift or estate taxes. As of 2024, that limit is $13.61 million per individual or $27.22 million for married couples. Estates valued below these thresholds aren’t subject to federal taxes.

Here’s how it works:

- The annual gift tax exclusion for 2024 is $18,000 per recipient.

- Any gifts up to this amount don’t count against your lifetime exemption.

- Any gifts that exceed the annual exclusion reduce your available lifetime exclusion.

Example: If an individual gifts $1.018 million this year to a beneficiary, their lifetime exclusion would be reduced by $1 million. (Gift of $1.018 million – annual exclusion of $18,000) = $1 million reduction to lifetime exclusion, which leaves the individual with $12.61 million left for their lifetime.

Key Takeaway: Making annual gifts up to the exclusion amount each year can be an effective way to gradually reduce your taxable estate, especially if you want to see the impact of your gifts while still living.

Historical Context

The estate exemption has evolved significantly over the past century. U.S. citizens were introduced to the estate tax exemption in the Revenue Act of 1916, which provided an exclusion of up to $50,000.

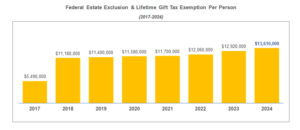

We have seen this figure grow over the years, but a large increase occurred in 2017 due to the Tax Cuts and Jobs Act (TCJA). This legislation more than doubled the previous federal estate exemption from $5.49 million in 2017 to $11.18 million in 2018 per individual. Now, in 2024, that number is $13.61 million per individual.

The increased exemption under the TCJA is set to expire on January 1, 2026. Without further congressional action, the federal estate exemption could return to $6-7 million per individual (the 2017 level of around $5 million adjusted for inflation).

Key Takeaway: The current high exemption level presents a unique opportunity for wealth transfer, but this window may potentially close soon.

Who Does the Estate Tax Affect?

The federal estate tax exemption plays a critical role for high-net-worth individuals and married couples, including:

- Business owners

- Entrepreneurs

- Investors with significant portfolios

- Farmers

- Those with expensive real estate holdings

These are a few individuals for whom the exemption acts as a shield for the portion of assets within the exclusion limit. High-net-worth individuals and married couples have the opportunity to protect their assets that have been built up, minimize tax burdens, and lay the groundwork for future generations.

Conclusion

Understanding the federal estate tax exemption is crucial for effective estate planning and wealth transfer. The historic high level offers a unique opportunity to protect and transfer assets, but it may have a clock ticking. By taking action sooner rather than later, you can help ensure that you maximize the transfer of wealth while minimizing the tax liability for your estate.

do you have questions on Federal Estate Tax exemption?

CONTACT USThe opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor. Past performance is not indicative of future results.