Wealth Building Strategy: Are You Playing Checkers or Chess?

Key Takeaway: Often in life, we can sit back and watch those playing checkers versus chess. Chess players play a longer-term game that is more strategic and has bigger payoffs. In your personal financial life, be a chess player.

I once played racquetball with a friend. He was several decades older than me, so I thought I would just hit the ball hard and make him run until he was out of breath. One of us was out of breath, and it was not him. His shot placement was incredible, as the ball was often only an inch or two off the floor, and the angles off the wall had me running like crazy. I lost to him so convincingly that it stuck with me for the last 30 years.

Have you ever run into people or situations where you just know they are playing chess while you might be playing checkers? Mastering this concept can make you better at many things in life—from sports to building a business to managing your finances.

Chess vs. Checkers

Before I jump into three ways chess players outmaneuver checkers players in wealth building, I would like to define what makes someone a chess player versus a checkers player. Checkers is a linear game with simple, predictable moves. You don’t have a lot of options, and therefore, your outcomes are also linear.

Chess, on the other hand, is more about foresight, creativity, and adaptability. There are thousands of moves on a chess board (probably more), and therefore, the outcomes can be exponentially bigger. To use a real-world investing concept, chess can reward risk.

This definition makes it easier to understand how some people play chess in wealth building and some play checkers. Checkers players avoid risks, tend to be more reactive, and therefore, settle for a sub-optimal outcome. Chess players tend to be longer-term thinkers (often in decades, or as I wrote in a previous blog, sometimes 100-year increments), tend to be more proactive, and want to optimize outcomes, even if that means it takes a lot of time.

In building wealth, the strategic way to consider these concepts, then, is to consider how to use large concepts to your (the chess player’s) advantage. Compound interest, use of leverage, risk management (in building a portfolio, using insurance, setting up corporate entities, etc.), and multiple income streams are all ways to play the game differently.

But I would like to focus on three real-world opportunities today that shine a light on how to think differently and further into the future than those around you.

Invest Like a Chess Player

We have all seen the studies that say timing the market doesn’t work and that it’s time in the market that matters. Often, we (me included) point out to clients that missing just the five best trading days in a year can cut your returns substantially, so stay invested. But what is not always discussed is how to stay invested. “How” is important and, in many ways, sort of boring.

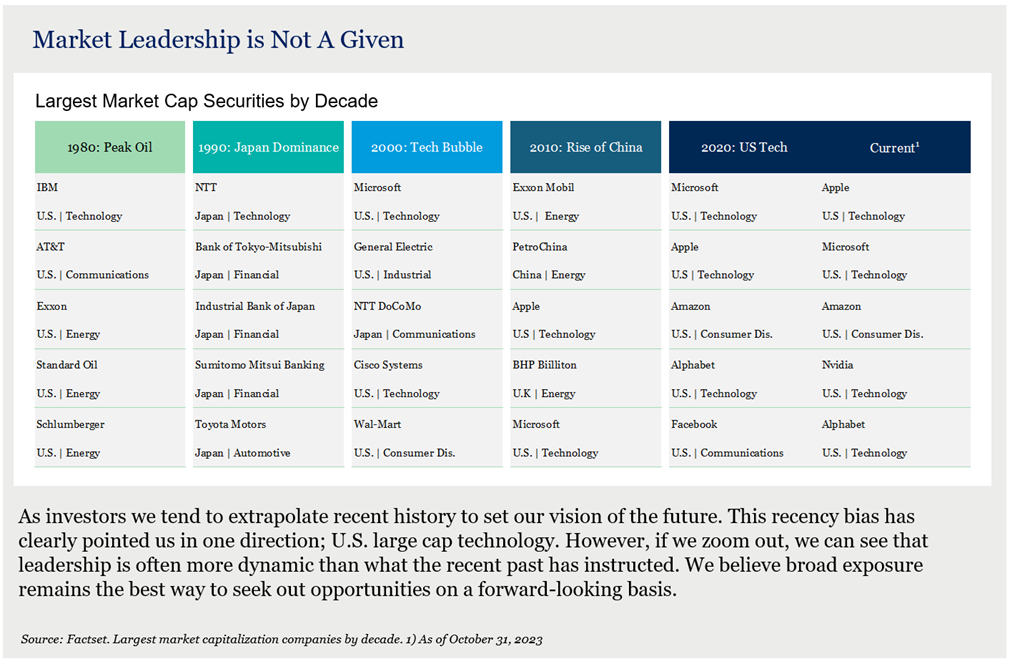

Picking stocks is exciting because people like stories. The reality of picking stocks, though, is that you need a lot of ongoing research, time, and insight to understand why a company continues to stay relevant versus if that same company has lost relevancy in the market. As an example, look at the chart below:

What is interesting to me in this chart is that stock leadership changes as much as it does from decade to decade. Many buy a stock because in the near term (the last year or two), the company looks like a real winner.

To be fair, many stocks won’t go out of business for decades. But if they become less relevant as our economy evolves, they can earn you less return. Thus, the question of how to invest is probably best answered for most people in buying mutual funds/exchange-traded funds (ETFs) within a strategic asset allocation and letting the markets do the picking for you. That is investing like a chess player, as it is a steady path but one that can mitigate risk.

Give Like a Chess Player

Giving to charity can be a simple task: Just write a check. But if you really want to leverage the opportunity, you could give an appreciated asset out of your portfolio.

Advantages of Giving Appreciated Stock to Charity

- You get to take a tax deduction based on market value.

- You give away your capital gains problem since the charity can sell it and not pay capital gains.

- If you don’t like the investment anymore, you have a clean way to give away a tax headache and clean up your portfolio at the same time.

- If you do like the investment, you can use cash to buy the investment in your portfolio and increase the cost basis to today’s price.

Now, let’s think like a chess player.

Instead of giving to charity one year’s worth of giving, what about five? Most people would say they don’t want to give that much to one charity upfront. But the way to do that is to use a donor-advised fund—essentially a brokerage account held by a charity that allows you to take a tax deduction for the gift in the year you give it, but then you can hand the money out over time. The reason to do this is to drive your giving into a year where you need more of a tax deduction (years with high income, a business sale, stock option exercises, etc.). And if you are a business owner with an asset (private company stock, real estate, etc.) that you want to give to charity, many charities will have that discussion with you as well.

Hire Like a Chess Player

My father was a small business owner who always told me to hire other small business owners to do work. His point was that you should let others who are experts at something practice their expertise (he was an electrician), saving you time to do what you are good at (or to give you time to spend with your children, which hopefully, you are good at as well).

At face value, hiring experts sounds smart. But we often don’t do it; we think we can control it ourselves or want to save money. And that thinking can get us into trouble. Experts often know of nuances that we don’t. They know of longer-term ramifications for our short-term decision-making. They know of opportunities and pitfalls. And sometimes, years later, they can reach out because they had a thought that would be super helpful.

Hiring experts means surrounding yourself with people whose only job is to see you succeed (however you want to define success). If I were to make a list of four or five experts everyone should have, it would be the following:

- CPA: An accountant that consults with you, not just does your tax return (and yes, you must pay more for this).

- Attorney: Not one attorney. Many attorneys. Attorneys each have a specialty, so you should have one for business issues, one for estate planning, one for employment concerns, and one for family matters (divorce, adoption, etc.). Be wary of hiring one and thinking they can do everything.

- Property/Casualty Agent: Work with an independent agency (not captive) so they can offer policies from many companies. I have found that they can often get a fair price (note that I didn’t say cheap) for fair language in the contract. At the end of the day, you need insurance that helps you in an emergency instead of fights you.

- Other Insurance Agent: If you need life insurance, disability insurance, or long-term care insurance, consider working with an independent agency here as well.

- Financial Advisor: Sorry, I can’t leave myself out. Focus on advisors who incorporate tax planning, estate planning, property/casualty, business issues, and charitable giving on top of investment management. Comprehensive planning is what gets you ahead.

Hiring like a chess player is like the advice Dan Sullivan would give. Ask who, not how.

Summary—It Feels Less Transactional

Checkers always felt like a transactional game to me where I move to win something (the other person’s checker). But chess captured my imagination differently because I must think many moves ahead. In investing and financial planning, short-term decisions have long-term ramifications, just like chess. If you are going to play the game, at least know which game gets you further ahead.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.

have questions or want to learn more about wealth building strategies?

Contact the experts at BGM or reach out to Jon Meyer, CFP® directly at JMeyer@BGM360.com.

You can also schedule a complimentary 30-minute introductory call with a fee-only financial advisor to discuss your personal situation.