It’s OK to Pass on Crytpo and NFTs

Key Takeaways:

2021 has had very little stock market volatility relative to history. However, it’s important to understand that risk doesn’t dissipate in stable market environments and that volatility is normal. It should be expected and anticipated.

Great emphasis is put on having a disciplined investment strategy during turbulent times. Yet that approach is equally as important during long stretches of positive market performance and muted volatility.

There are a lot of shiny objects these days in the investment world (cryptocurrencies, NFTs, meme stocks, SPACs, just to name a few), and all receive a disproportionate share of the financial headlines. Understand the risks associated with these investments before allocating capital to extremely volatile asset classes.

2021—Historically Low Volatility

COVID-19 and fears of a global depression wreaked havoc on the financial markets in March 2020, causing stocks to fall +35% in just 33 days. Fast-forward to 2021, and such severe volatility seems like a distant memory as markets continue to grind upward.

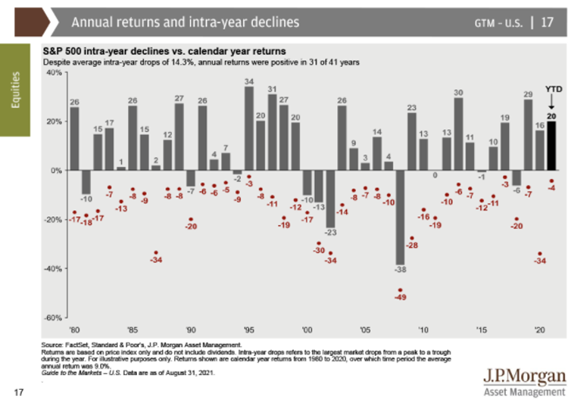

However, price instability is a characteristic of equity markets that should be expected. Consider the following chart, which indicates the average intra-year drawdown since 1980 has been 14.3%. That in and of itself is a jarring statistic, but more impressive is even with average intra-year declines north of 14%, over 75% of the annual returns in the same reporting period were positive.

There may not be a more convincing chart that supports buy-and-hold investing.

Source: J.P. Morgan Guide to Markets, data as of August 31, 2021.

Looking at individual years, you can see how calm markets have been during the 2021 calendar year. The S&P has delivered +20% returns through August, all while seeing a maximum drawdown of only 4%.

Compare that with the average over the last 40 years and investors can consider themselves lucky to have such a smooth ride. However, it’s in these environments when complacency starts to overcome investing discipline.

Low Volatility + Bull Market = More Risk?

A common theme of investors who lack discipline is the rotation away from traditional investments, such as stocks, bonds, and real estate, and into assets that do not produce cash flow. Investment risk, or the risk of financial loss, is all but forgotten as the thought of parabolic moves (generating massive returns in a short period) is just too intoxicating.

Before examining the recent popularity of some non-cash-flow-producing assets, it’s important to level-set on the topic of valuation. A widely accepted basis for valuing any asset is the use of discounted cash flow models (there are others—asset-based valuation, relative valuation, etc.).

In essence, the outcome of this approach is determined by discounting future earnings and cash flows back to present value. It’s a process that has subjective inputs and is arguably more art than science, but it’s tangible, widely understood, and its methodology is based on real underlying data.

On the other end of the spectrum are assets that don’t produce cash flow. In the absence of cash flows, these assets must derive their value from a variety of non-quantitative factors—supply and demand, investor perceptions, etc. Some of the more common non-cash-flow-generating assets are gold, art, and collectibles. More recent assets in this category are cryptocurrencies and non-fungible tokens (NFTs).

Why does valuation matter? In the absence of a sound valuation methodology, you are simply justifying an asset price based on another investor’s willingness to pay a higher price in the future. Said another way, if your investment thesis lacks fundamental analysis, you are purely speculating.

Cryptocurrencies

Cryptocurrencies may have a place in our society at some point; however, I don’t see them as a currency—their value is far too unstable—and the ultimate use case at this point is difficult to determine.

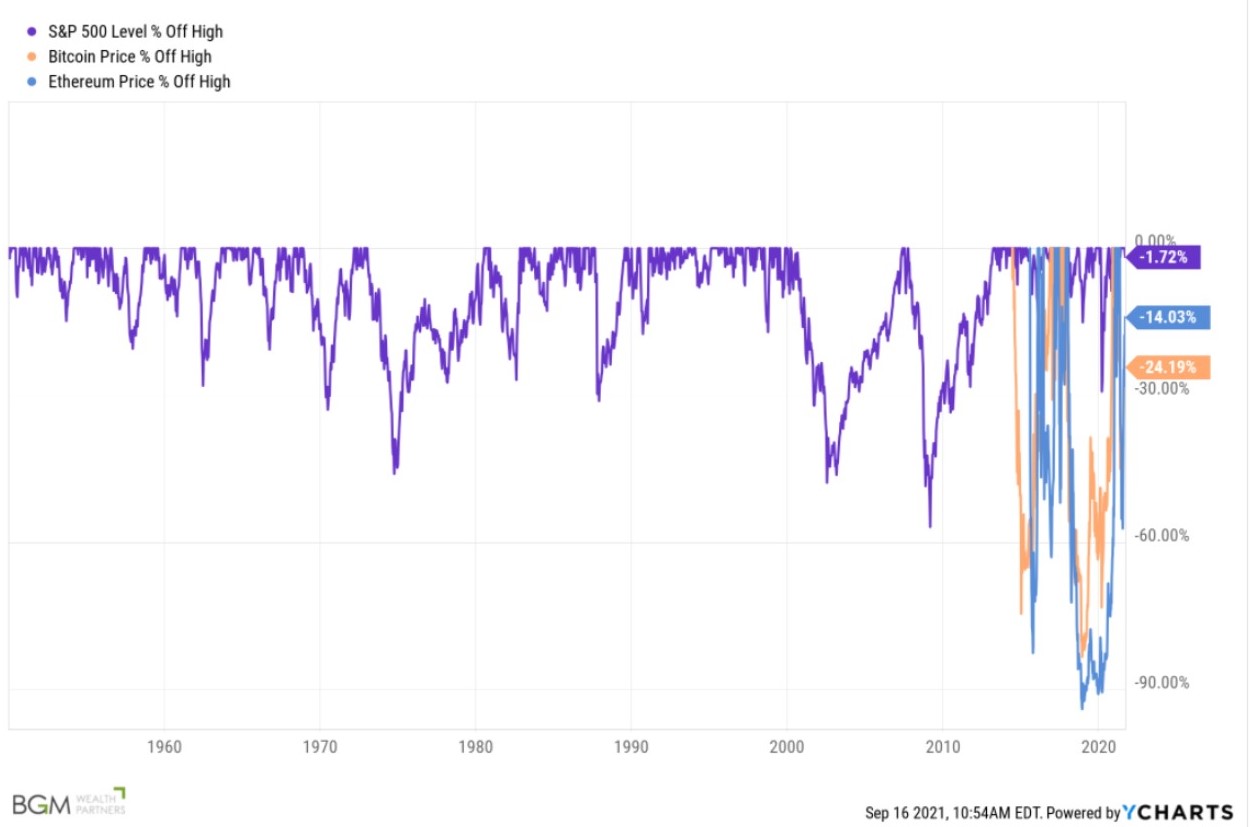

Consider the following chart comparing the max drawdown for the S&P 500 alongside the two largest cryptocurrencies when measured by market cap, Bitcoin and Ethereum. Going back to 1950, the maximum drawdown for the S&P 500 hasn’t exceeded -50%, and there have been only three occurrences where drawdowns exceeded 40% in a 70-year time horizon.

Conversely, it looks like you are in for a +60% drawdown every 12 months or so with cryptocurrencies, and it’s not uncommon to see 80-90% price depreciation.

Whether it’s cryptocurrencies, NFTs, special purpose acquisition companies (SPACs), or beanie babies, at least evaluate the risks, liquidity, and purpose for holding such assets. These assets may be exciting, but rarely, if ever, does excitement belong in your portfolio.

Non-Fungible Tokens

An even more recent phenomenon is the emergence of digital collectibles. Known as non-fungible tokens (NFTs), these digital assets have been introduced to the market as one-of-a-kind online property that is easily identifiable and authenticated on the blockchain. However, just like physical art, these pieces of property can be reproduced.

At this juncture, the only reasonable explanation for their skyrocketing value is perceived scarcity. And that alone may be enough for some novice investors to dive headfirst into the speculative frenzy. However, it’s hard to rationalize some of the recent purchases as sound investments (feels reminiscent of the beanie baby craze of the late ’90s, doesn’t it?).

Just look at a few of these headlines:

- People are Buying $200,000 NFT Rocks

- JPG File Sells for $69 Million, as ‘NFT Mania’ Gathers Pace

- LeBron James NBA Top Shot Sells for Over $387,000

This all begs the question—if your existing portfolio didn’t have an art/collectible allocation prior to NFTs, what’s a reasonable rationale for even considering investing in them other than FOMO (fear of missing out)?

You Don’t Have to Swing at Every Pitch

People will generate massive amounts of wealth with cryptocurrencies, non-fungible tokens, special purpose acquisition companies, meme stocks, and other emerging ideas that will all be coined as disruptive and lucrative.

In the near term, this will likely be magnified as the economy is flush with cash and artificially low-interest rates create an environment where disciplined, prudent strategies are overshadowed by the thrill of quick profits. While this is happening, it’s OK to sit on the sidelines.

For most people, the point of investing is to mitigate risk while protecting and preserving the investable assets in a portfolio. Remember, it’s healthy to have a little excitement in life, but it doesn’t belong in your portfolio. If you have questions or would like to learn more, please fill out our contact form to schedule an appointment with our team.

The opinion of the author is subject to change without notice and must be considered in conjunction with relevant regulation, as well as subsequent changes in the marketplace. Any information from outside resources has been deemed to be reliable but has not necessarily been verified. Each individual has unique circumstances to which this information may or may not be relevant. Under no circumstances will this information constitute an offer to buy or sell and it does not indicate strategy suitability for any particular investor.